Moniepoint Login: Secure Access to Your Business Dashboard

Here at Social Think, we focus on helping businesses grow by using smart social media strategies and deep analytics. We know that a business’s success depends on more than just great marketing; it also requires reliable tools to manage finances effectively.

That is why we are taking a close look at Moniepoint, a key player in Nigeria’s financial technology landscape. Understanding how to access and use your financial tools is the first step toward having complete control over your business operations.

Moniepoint has become a go-to financial partner for many businesses and individuals across Nigeria.

It provides a range of services, from a flexible business account to a user-friendly personal banking platform. The company is especially known for its reliable POS terminals, which have empowered countless agents and small business owners.

Because this platform is central to managing your money, having a smooth and secure Moniepoint login experience is essential. This guide will walk you through everything you need to know about accessing your account, solving common problems, and keeping your financial info safe.

How to Complete Your Moniepoint Login (Step-by-Step)

Getting into your Moniepoint account is a straightforward process.

By following these steps, you can securely access your financial dashboard and manage your funds, whether for your business or personal use.

Before you begin, ensure you have a stable internet connection to prevent any interruptions.

Visit the Official Moniepoint Website

The first and most important step is to make sure you are on the correct website. Always navigate directly to the official Moniepoint site to perform your login. Scammers often create fake websites that look identical to the real one to steal your username and password.

By going to the official source, you protect your bank account from unauthorized access. Bookmark the correct page in your browser for future use to make it easier and safer to access.

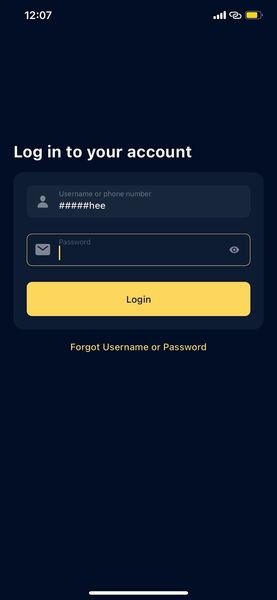

Enter Your Registered Email Or Username

Once you are on the official login page, you will see fields asking for your credentials.

In the username field, type the email address or username you used when you first registered for your account.

For many users, this is their primary email, which is why some people search for terms like Moniepoint login Gmail. Your username is the unique identifier for your business account or Moniepoint personal bank account, so be sure to enter it correctly.

Input Your Secure Password

Next, carefully type your password into the corresponding field. Passwords are case-sensitive, so make sure your Caps Lock key is off unless your password contains uppercase letters. If you use a browser like Google Chrome, you might be prompted to save your password.

This feature, related to the chrome moniepoint login password query, can be convenient for future logins. However, be cautious if you share your computer with others, as saved passwords can pose a security risk. It is always safest to type it in manually.

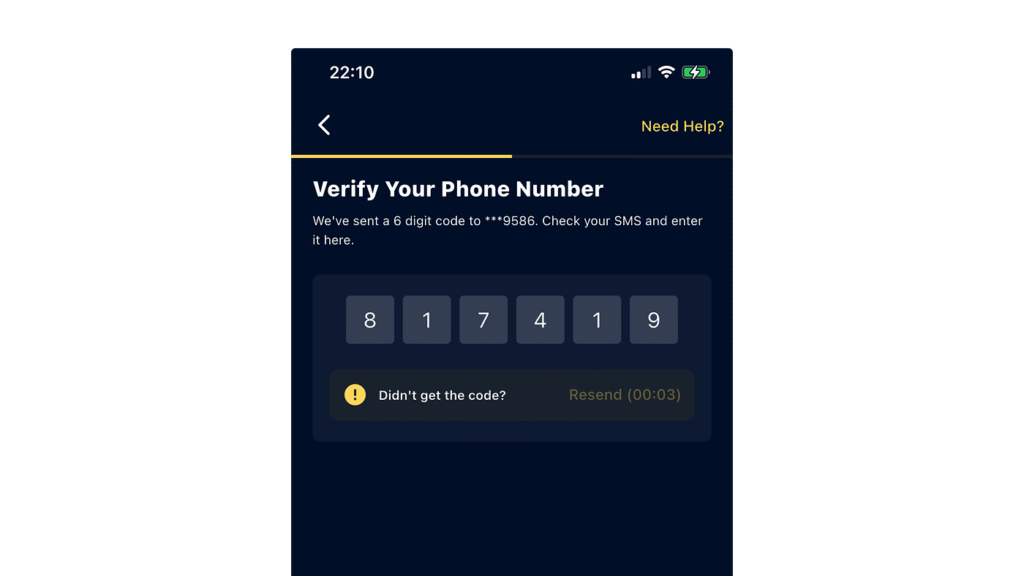

Complete Two-Factor Authentication (2FA) If Enabled

For an extra layer of security, Moniepoint encourages using Two-Factor Authentication (2FA).

If you have this feature activated, you will be asked to complete a second verification step after entering your password.

This usually involves entering a one-time code that is sent to your registered phone number via SMS or generated within your Moniepoint banking app. This step ensures that only you can access your account, even if someone else knows your password.

Troubleshooting Common Moniepoint Login Problems

Even with a simple login process, you might occasionally run into issues. Whether it is a forgotten password or an unexpected error message, most problems have a quick solution. Here is how to handle some of the most common login hurdles.

What to Do If You’ve Forgotten Your Password?

Forgetting a password is a common issue.

If you cannot remember yours, look for a “Forgot Password?” or “Reset Password” link on the login page. Clicking this will start the recovery process. You will typically be asked to enter the email address associated with your account.

Moniepoint will then send you an email with a secure link and instructions on how to create a new password. Following these steps will help you regain access to your bank account without compromising its security.

Resetting Your Moniepoint Login PIN

Your login password and your transaction PIN are two different things. The password grants you access to your account, while the PIN authorizes transactions like transfers and payments from the app.

If you forget your PIN, you can usually reset it from within the security settings of the MoniePoint personal banking app. The process often requires you to confirm your identity by entering your password or answering security questions.

Resolving “Invalid Credentials” Or “Account Locked” Errors

Seeing an “Invalid Credentials” error means that the username or password you entered does not match the records on file.

Double-check for any typos. If you try to log in with the wrong password multiple times, Moniepoint may temporarily lock your account to protect it from suspicious activity. When this happens, you will see an “Account Locked” error.

The best thing to do is wait for 15-30 minutes before trying again. If the issue persists, you may need to contact support.

How to Contact Moniepoint Support For Login Help?

If you have tried the troubleshooting steps and still cannot access your account, it is time to contact Moniepoint’s support team. You can find their official contact info on the Moniepoint website or within the app.

They offer support through email, phone, and sometimes a live chat service. Although the Moniepoint Microfinance Bank has its headquarters at 12 Admiralty Road, Lekki Phase 1, in Lagos State, your quickest path to a solution will be through their official digital support channels.

Moniepoint Login For the Mobile App Vs. Web

Moniepoint offers two primary ways to access your account: through its mobile app and a web browser. Each platform is designed for convenience, but they offer slightly different experiences tailored to different needs.

Logging in on the Moniepoint Business App (Android & iOS)

The Moniepoint mobile app, often called the moniepoint personal banking app or business app, provides a streamlined experience for managing your finances on the go.

After downloading it from the Google Play Store or Apple App Store, your first login will require your username and password. After that, you can often enable biometric login, such as fingerprint or face ID, for faster access.

Before installing any financial app, it is a good practice to review the developer’s privacy policy. This document explains the app’s privacy practices and the company’s approach to the handling of data, giving you peace of mind about your information.

Accessing Your Account Via A Web Browser

For those who prefer a larger screen or are working from a computer, accessing Moniepoint through a web browser is an excellent option. This is especially useful for agents managing their operations or business owners reviewing detailed financial reports.

The web portal is fully featured, allowing you to perform all the same actions as the mobile app. The login process for agents using their POS terminals often happens through a built-in web browser, which is where the term Chrome MoniePoint login pos originates.

Key Differences For Agents and Business Owners

Although the login page might look the same, what you see after logging in depends on your account type. A moniepoint agent login will take you to a dashboard designed for managing a POS business. Agents can track transactions, view commissions, and manage their terminals.

In contrast, a business owner logging into their business account will see a dashboard focused on company finances.

From here, they can pay salaries, manage business expenses, view analytics, and apply for working capital loans. These capital loans are designed to help businesses grow without the hassle of traditional banking.

Keeping Your Moniepoint Login Information Secure

Your Moniepoint account contains sensitive financial data, so protecting it is extremely important. Following some basic security practices can help you keep your account safe from unauthorized access.

How to Spot A Phishing Scam?

Phishing is a technique scammers use to trick you into revealing your login information.

They often send emails or text messages that look like they are from Moniepoint, creating a sense of urgency to get you to click a link and enter your details. A real message from Moniepoint will never ask you for your full password, PIN, or other sensitive info.

Be suspicious of any message that contains typos, has a generic greeting, or directs you to an unfamiliar website.

The Importance Of A Strong, Unique Password

Your password is the main gatekeeper to your account. A strong password gives you complete control over your account’s security.

Create one that is long (at least 12 characters) and includes a mix of uppercase letters, lowercase letters, numbers, and symbols. Avoid using easily guessable information like your birthday, business name, or “password123“.

Most importantly, use a unique password for your moniepoint personal bank account that you do not use for any other service.

Why You Should Never Share Your Login Details?

Your login credentials should be kept completely private.

Never share your password or PIN with anyone, not even with someone claiming to be from Moniepoint.

Sharing this information gives another person full access to your bank account, allowing them to view your balance, see your transaction history, and potentially steal your money. Keeping your login details to yourself is a simple but powerful way to protect your finances.

FAQ’s:

Can I Use Moniepoint Login Gmail to Sign In?

Yes, you can. The “Gmail” part simply refers to the email provider you used when you created your Moniepoint account.

If you registered with a Gmail address, you will use that full email address as your username to log in. You can use an email from any provider, such as Yahoo, Outlook, or a custom domain, as long as it is the one associated with your account.

What Should I Do If I Don’t Receive My Moniepoint Verification Code?

If you are expecting a verification code via SMS for 2FA and it does not arrive, first check to ensure your phone has a signal. Also, confirm that the phone number registered with your Moniepoint account is correct.

Sometimes, there can be a delay with the mobile network, so wait a few minutes. If it still does not arrive, use the “Resend Code” option. A poor internet connection does not affect SMS, but it can affect codes delivered through the app.

How Do I Reset My Password If I’m Unable to Access My Moniepoint Account?

If you cannot access your account because of a forgotten password, use the “Forgot Password?” link on the Moniepoint login page. You will need to enter your registered email address to receive a password reset link.

Follow the instructions in the email to set a new, secure password and regain access to your account.

Is the Login For the Moniepoint Agent Platform Different From the Business Owner Platform?

The initial login page is generally the same for both agents and business owners. You enter your username and password in the same place.

The difference appears after you log in. Moniepoint’s system recognizes your account type and directs you to the appropriate dashboard—either the agent dashboard for managing POS transactions or the business dashboard for managing company finances.

How Can I Set Up Two-Factor Authentication (2FA) For Extra Security During My Moniepoint Login?

Setting up 2FA is highly recommended. To do this, log into your Moniepoint account via the app or website and navigate to the “Security” or “Profile” section. Look for the Two-Factor Authentication option and follow the on-screen instructions. You will typically need to link your phone number to receive verification codes, which adds a critical layer of protection to your account.

My Moniepoint Account is Showing an “Account Locked” Error After Several Login Attempts. What Do I Do?

An “Account Locked” error is a security measure to protect your account after too many incorrect password attempts.

In most cases, the account is only locked temporarily. The best course of action is to wait for about 30 minutes and then try to log in again with the correct password. If you have forgotten your password, use the reset option instead of guessing.

If your account remains locked, you should contact Moniepoint support for assistance.

Conclusion

Successfully logging into your Moniepoint account is the gateway to a suite of powerful financial tools designed for modern life and business in Nigeria. Whether you are paying utility bills, sending money, managing your debit card from the card menu, or topping up airtime, the platform offers a seamless experience. As a microfinance bank licensed by the Central Bank of Nigeria, Moniepoint is committed to providing reliable services without hidden charges, and its team works hard to fix any pesky bugs to improve the user experience.

Features like cashback on transactions and access to working capital loans further show its value.

Gaining complete control over your financial tools is a major step toward running your business efficiently. In the same way, gaining control of your social media presence helps your brand grow and connect with customers.

At Social Think, we provide the expert strategy and analytics to make that happen. If you are ready to see what data-driven insights can do for your brand, get in touch with us today.